Most wealth management firms have an ageing client base, predominantly those over 60 years old (baby boomers) and over 75s – the silent generation. To combat this, they target their acquisition activity to wealthy investors of 45 years old (generation x) and over.

The conventional thinking is that 45-55 is the age when people have already established their own wealth and are likely to start inheriting from their baby boomer parents.

Conventional thinking also dictates that millennials (26-41 year olds) are mostly too financially squeezed to meet the threshold of an attractive prospect for wealth management services.

This conventional thinking has held true for the past 100 years.

But these are unconventional times.

“…the number of UK millennial and generation Z millionaires has doubled in the past year…”

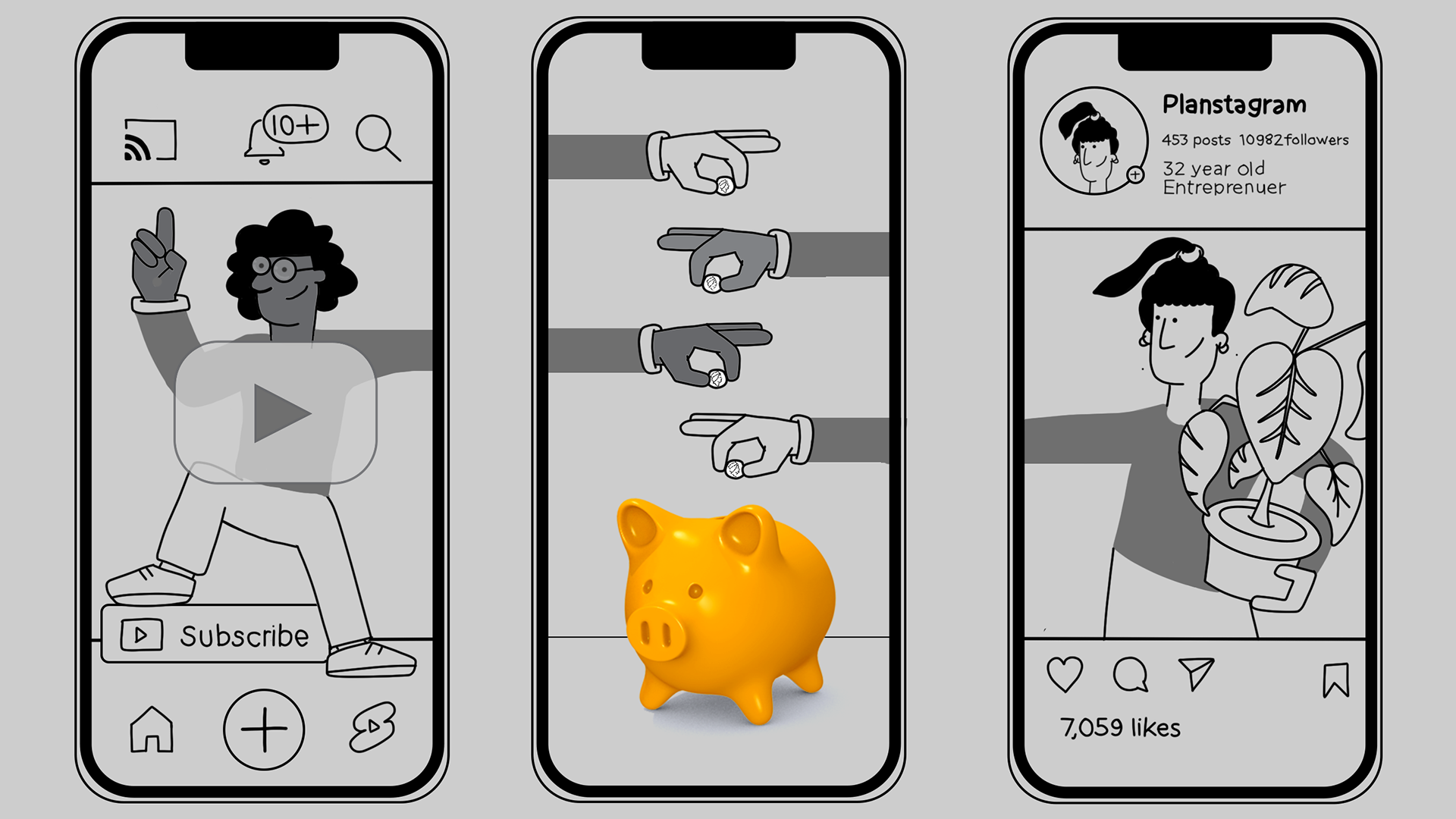

Research by the Bowmore Wealth Group in February 2022 reports that the number of UK millennial and generation Z millionaires has doubled in the past year. The research also shows a 28% increase in millennial and Gen Z taxpayers declaring income over £150,000. This is largely due to a surge in pay for workers in tech/fintech and a boom in millennial entrepreneurship. The number of younger high-earners working in areas such as sport and social media influencing is also rising.

Much has been said about the projected intergenerational wealth transfer. The narrative is that globally baby boomers will pass on between $30tn and $68tn (depending on which report you read) of their wealth to their millennial children within the next 10-20 years.

But there is growing evidence that the wealth transfer is skipping a generation. The silent generation are passing their wealth to their millennial grandchildren, and Gen Z are inheriting from their baby boomer grandparents.

And this wealth is dropping on a generation that seems to have a greater propensity to invest than their parents, according to surveys by Finder.com and the Royal Mint.

View image in blog here.

You’d think that wealth management companies are well positioned to capitalise on this opportunity. Surely they can parley their long-held relationships across to the inheriting generations? Apparently not.

“…only 13% of affluent investors choose to work with the same advisor their parents used…”

Research by Cerulli Associates reports that only 13% of affluent investors choose to work with the same advisor their parents used. Among the remaining 87%, a whopping 88% of them said they never even considered doing so. The impact of this is seemingly dramatic. Accenture reports that wealth managers expect to lose, on average, one-third (32%) of their client’s wealth at the point of succession. That’s an estimated outflow of $1.5tn per annum.

It’s little wonder that the wealth management sector is struggling with this tide of change. Industry figures show that the average age of wealth advisors is rising to around the high 50s, with only 11.7% under the age of 35.

“…the average age of wealth advisors is rising to around the high 50s…”

The received wisdom about millennial and Gen Z prospects, meanwhile, is that they’re more self-directed than older generations, and demand technology that enables them to take control over their finances. They have a wealth – pun intended– of information at their fingertips, and in many respects consider themselves more knowledgeable than their advisor (in 64% of cases, according to Accenture research).

An Accenture poll of millennials highlights the stress this generation gap places on trust, which is essential in a relationship-centric business. 57% of respondents perceived their advisor to be motivated by their own earnings alone – as opposed to the client’s financial success – and less than a third of them felt their advisor took the time to get to know them. Combined with the fact that 51% of them agreed with the statement: “I try to avoid situations where people tell me what to do,” it’s clear advisors have their work cut out for them.

So, can wealth management firms ride the storm? Or is the writing on the wall? Recent research suggests the former – and the storm may not be as overwhelming as it seems.

In 2022 Natixis surveyed 8,550 millennials globally with a minimum of $100,000 in investable assets. The results ran against prevailing perceptions, showing that robo-advice has only captured a small percentage of the market.

See image in blog here.

The research concludes that a primary reason for this lies in the fact their lives become more complex as they turn 30, and they look for personal advice, either as a sole source, or as part of a blended approach to their finances.

Technology is a core enabler of these relationships, providing ease of access and transparency of information combined with multi-channel lines of communication between client and advisor.

While, according to Accenture, most millennials are confident in their own knowledge of holdings and investments, 59% of them want education on financial basics like cashflow and budgeting, with an equal focus both on short-term and long-term goals.

Millennials will also be experiencing one of the most dramatic periods of volatility they’ve seen as investors, with 48% of respondents focused on risk management over a fund’s ability to beat the benchmarks (26%) when selecting investments.

The generalisation that millennials are champions of impact investment is also challenged. While 78% considered their wealth as an extension of their values, and 52% said they were interested in ESG (environmental, social and governance) investments, only 27% said they were currently invested in ESG funds. And though a Schroders study shows that the majority UK millennial investors are driven by their personal beliefs, 20% of them would actually compromise those beliefs if the returns were high enough.

Time to advertise outside the box?

These statistics combine to show that it’s risky to approach millennials using commonly held generalisations and assumptions about generational differences. They’re just like any other investor, just at a different life-stage. Indeed, Accenture segment their millennials-focused research panels into very recognisable attitudinal personas.

“…it’s risky to approach millennials using commonly held generalisations and assumptions about generational differences…”

Sure, millennials can be driven by values, but not all of them are. And their parents are just as likely to make ESG investments as they are.

Yes, the research shows that, when asked, millennials don’t like being told what to do. But who does? A good wealth manager works together with their clients – something that UBS reflect so well in their core proposition as we saw in our first article.

Certainly, a large proportion of inheritors sack their parent’s advisor. But that’s not because they want specialist millennial-tailored advice. It’s because they were excluded from the conversation – ignored – just as we found women were in our previous article.

Millennials are information-hungry, goal-driven and ask a lot of questions, as do women. But is that so different to the rest of the investor population? Again, goals and questions are central to the well-considered UBS narrative. It certainly doesn’t marginalise anyone. It’s an inclusive and contemporary attitude.

And as for that old trope that millennials are different because they’re digital natives – well, we’ve actually reached a point of societal digital maturity. We all expect digital service. There’s no such thing as a digital offering that’s just for millennials.

Good digital communications and experiences are effective when they work with the strengths of the medium and are driven by common heuristic behavioural principles.

The key, we believe, to attracting a millennial audience is to apply the same approach UBS has successfully applied to attracting women:

In our opinion, Schroders Personal Wealth comes the closest to achieving this.

The use of the word ‘dreams’ in the opening narrative of the website is clever. Dreams are more emotive than ‘goals’. They’re less pragmatic and dry. You dream about the future. But it’s an inclusive word – and not a sole preserve of the young. Our dreams may change as we get older, but they become no less potent.

There are some digitally savvy touches too. The online profiling tool and Trustpilot rating should appeal to millennials. But again, they won’t exclude the wider audience– these are things we’re all familiar with. They’re very appropriate for the medium, but their use on a wealth management site makes the firm feel fresh and down to earth in its approach.

See image in blog here.

Scroll down the homepage and you’ll find the succinctly put proposition. Unlike most wealth management propositions which steadfastly talk about what they do, Schroders project the way they think. Their attitude. Their purpose. This makes them feel distinctive, fresh and contemporary. It will certainly resonate with a millennial audience, but again it’s inclusive of other generations.

See image in blog here.

All of this is quite subtle and, taken at face value it could be seen as the application of afresh image for a generalist wealth management firm. But dig a little deeper, and you can see that the firm has definitely included millennials as an integral part of their strategy.

MoneyLens is a website from Schroders aimed specifically at millennials and Gen Z. It provides jargon-free articles about investing and saving money, all written and run by a group of young professionals working at Schroders. This crucially gives the site credibility and helps it avoid any hint of patronising cynicism – which tends to be another product of conventional thinking.

See image in blog here.

We covered Schroders in our first article in this wealth management marketing series, in which we analysed the effectiveness of a number of brand advertising campaigns. The campaign we looked at didn’t reflect the proposition and tone that Schroders more recently achieves. Our analysis concluded that this campaign likely had very little effect on brand awareness due to its messaging, reach and frequency.

In our opinion, the current messaging would work well for Schroders if they decided to put some advertising weight behind it, positioning them effectively in the mid-market with added millennial appeal.

With Schroders at the premium end with an inclination towards women, and ABRDN catering across the board to the mass-affluent, there’s certainly room in the market for more a millennial-centric approach – and it’s sure to deliver a solid return on investment.

Don’t miss the next part in our wealth management marketing series, coming soon.

In the meantime, if you have any queries about marketing to millennials – or anyone else for that matter – don’t hesitate to get in touch with our team at [email protected]

From tackling your marketing painpoints to delivering global brand strategies, Proctor + Stevenson is the B2B marketing specialist that says YES to your commercial challenges.

You need to load content from reCAPTCHA to submit the form. Please note that doing so will share data with third-party providers.

More Information