Chancellor Jeremy Hunt delivered the government’s 2023 Autumn Statement on 22 November. Here’s a round-up of measures and announcements relevant to businesses in the creative industries.

If you’re a Bristol Creative Industries member and you’d like to share your view on Autumn Statement 2023, email Dan.

In the full Autumn Statement document released after the speech, the government says:

“The UK has world-leading creative industries at the heart of an increasingly digital world. The sector grew at over one and a half times the rate of the wider economy between 2010 and 2019,73 contributing £126 billion in GVA in 2022.

“In June 2023, the government published its sector vision which set ambitions to grow the creative industries by £50 billion and deliver a creative careers promise to support a million more jobs by 2030. This included £77 million in new government spending, bringing the total announced since the 2021 Spending Review to £310 million. The sector also continues to be supported by significant tax reliefs, which were worth £1.66 billion in the year ending 2022.”

In terms of specific announcements for the creative sector, the Autumn Statement included the following:

In his speech, Jeremy Hunt said:

“Our creative industries already support Europe’s largest film and TV sector. This year’s all-Californian blockbuster Barbie was filmed in the constituency of the Hon Member for Watford, where the sun always shines.

“I know that even more could be invested in visual effects if we increased the generosity of the film and high-end TV tax credits, so I will today launch a call for evidence on how to make that happen.”

In the consultation document published after the speech, the chancellor says:

“I can confirm that we will provide more additional tax relief for expenditure on visual effects, to boost the international competitiveness of the UK’s offer. This call for evidence takes the first, crucial step towards this, as it will provide the government with the depth of understanding it needs to develop targeted proposals that best serve the needs of the visual effects industry.”

The call for evidence follows the announcement in the government’s March Budget that audio-visual tax reliefs are being reformed into expenditure credits with a higher rate of relief than under the current system. The new expenditure credits can be claimed from 1 January 2024.

The government is looking for comments on how the new Audio-Visual Expenditure Credit can provide more generous tax relief for visual effects by 3 January 2024.

Neil Hatton, CEO of UK Screen Alliance, said:

“Very often clients will say, ‘We love your creativity, your innovation and reliability to deliver. We love your people and we love working in the UK, but your VFX incentive doesn’t meet what is available elsewhere in the world’. Either that or, ‘We are capped out’.

“This consultation and the promise of a more competitive incentive should aim to position the UK as the first choice destination for VFX production for international film and TV. We are focused on capturing a larger market share as global demand for VFX recovers, following the US actors’ strike, and we aim to play a full part in growing the UK’s creative industries towards the government’s 2030 targets.”

The government said it will provide £2.1 million of new funding next year for the British Film Commission and the British Film Institute Certification Unit “to support the production of film and high-end TV across the UK”.

The unit certifies films, animation, television programmes and video games as British or as an official co-production in order to be eligible for the UK’s creative sector tax reliefs. The BFI has previously said that it lacks funding to adequately adminster the certification.

The government said it will review public investment in R&D spending for the creative industries “to a Spending Review timeframe”.

The 75% business rates relief for hospitality, retail and leisure businesses up to a rateable value of £110,000 has been extended until 2024-25, and the small business rates multiplier has been frozen at 49.9p.

The standard multiplier (paid by properties with a rateable value of £51,000 or more) will be uprated by September’s CPI next April (6.7%). This will mean an increase from 51.2p to 54.6p.

At the Spring Budget, the government extended the temporary higher rates of relief of three corporation tax reliefs that are collectively known as the ‘cultural reliefs’:

In a policy paper published alongside the Autumn Statement, HM Revenue & Customs said “the government is taking the opportunity to clarify some of the relief rules, including what is eligible for relief” in order to “provide clarity to the industry and ensure the fairness and success of the cultural reliefs”.

In a policy paper published alongside the Autumn Statement, the government said companies claiming tax relief for films, high-end TV, animated TV, children’s TV, video games, theatrical productions, orchestral concerts and museum and gallery exhibitions will be required to complete and submit an online information form.

This include claims made for the new expenditure credits: the Audio-Visual Expenditure Credit (AVEC) and the Video Games Expenditure Credit (VGEC). It also includes the cultural tax reliefs: Theatre Tax Relief (TTR), Orchestra Tax Relief (OTR) and Museums and Galleries Exhibition Tax Relief (MGETR).

The reason given is as follows:

“It is expected that these changes will streamline the process of making a claim and assist companies in transitioning to the new regimes. The completion and submission of the online information form will make it easier to tackle abuse and will reduce the administrative burden on HMRC, allowing claims to be processed faster.”

For AVEC and VGEC, the measure will take effect from 1 January 2024. For the cultural reliefs, it be introduced from 1 April 2024.

Freelancers make up a third of the creative industries so these measures are very relevant to the sector.

From 6 April 2024, self-employed people with profits above £12,570 will no longer be required to pay Class 2 National Insurance Contributions, while the main rate of Class 4 self-employed NICs will be cut from 9% to 8%.

The government said the changes will benefit around two million self-employed people with the average person earning £28,200 seeing a saving of £350 in 2024-25.

Compute powers the development of AI models.

The goverment will invest £500 million in further UK based compute over the next two financial years “so that universities, scientists and start-ups have access to the compute power they need to help make the UK an AI powerhouse”. This brings the total planned investment in compute to more than £1.5 billion.

The following are announcements not specific to the creative industries but are of interest to businesses in the sector.

Full expensing allows companies to claim 100% capital allowances on qualifying plant and machinery investments and write off the cost of investment in one go. For every pound a company invests, their taxes are cut by up to 25p.

The measure was due to end in March 2026 but the Autumn Statement announces that it has been made permanent.

The government said it worth over £10 billion a year and “the biggest business tax cut in modern British history”.

Alongside the Autumn Statement, the government published the report from its Prompt Payment and Cash Flow Review.

Measures aimed at tackling the impact of late payment on small businesses include:

The government will establish a Growth Fund within the British Business Bank to provide a permanent capital base of over £7 billion “to give pension funds access to investment opportunities in the UK’ s most promising businesses”.

Exentions of the British Business Bank’s Future Fund: Breakthrough programme with at least £50 million additional investment in “the UK’s most promising R&D intensive companies”.

A new Venture Capital Fellowship will be set up with the aim of “producing the next generation of world-leading investors in the UK’s renowned venture capital funds to support investment into the UK’s most innovative high-growth companies”.

A new £20 million cross-disciplinary proof-of-concept research fund to boost spin-out businesses in universities.

The existing Research and Development Expenditure (RDEC) and SME schemes will be merged for expenditure incurred in accounting periods beginning on or after 1 April 2024. The notional tax rate applied to loss-makers in the merged scheme will be lowered from 25%

as per the current RDEC scheme, to 19%.

The intensity threshold in the additional support for R&D intensive loss-making SMEs will be reduced from 40% to 30%, which the government says brings around 5,000 more R&D intensive SMEs into scope of the relief.

A one year grace period will be introduced so that companies that dip under the 30% qualifying R&D expenditure threshold will continue to receive relief for one year.

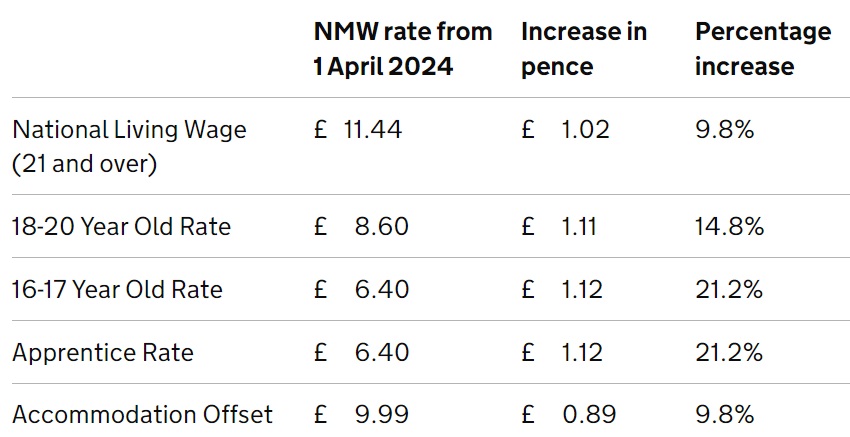

From April 2024, the National Living Wage (NLW) will increase by 9.8% to £11.44 with the age threshold lowered from 23 to 21 years old. The government said it represents a rise of over £1,800 to the annual earnings of a full-time worker on the NLW.

There are also changes in the National Minimum Wage:

Bristol Creative Industries is the membership network that supports the region's creative sector to learn, grow and connect, driven by the common belief that we can achieve more collectively than alone.

You need to load content from reCAPTCHA to submit the form. Please note that doing so will share data with third-party providers.

More Information